- Market Overview

- Futures

- Options

- Custom Charts

- Spread Charts

- Market Heat Maps

- Historical Data

- Stocks

- Real-Time Markets

- Site Register

- Mobile Website

- Trading Calendar

- Futures 101

- Commodity Symbols

- Real-Time Quotes

- CME Resource Center

- Farmer's Almanac

- USDA Reports

Why using orderflow with intraday futures price action and following our methodology works

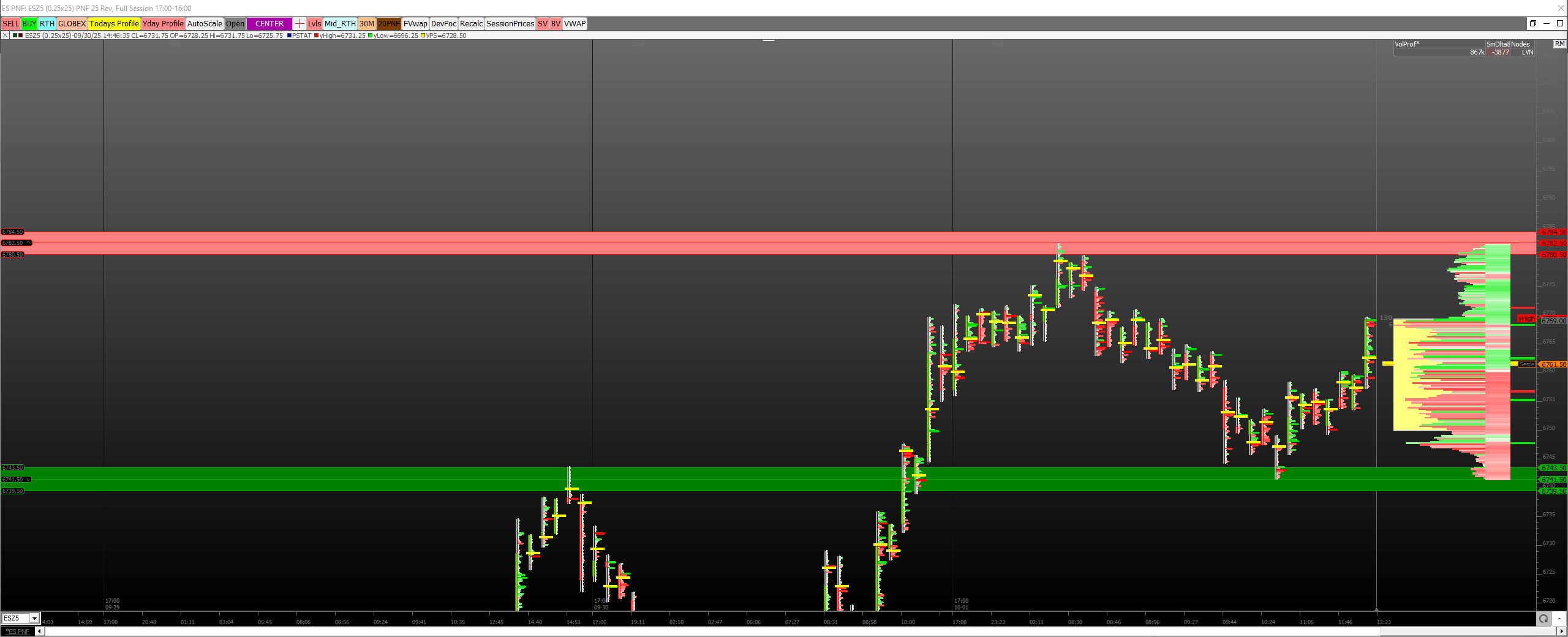

Intraday futures trading using order flow involves the analysis of real-time buying and selling activity to predict future price movements. At Trade Guidance, we employ tools such as point-and-figure footprint charts, weighted-volume profiles, time and sales data, and depth of market to monitor order placement, identify supply and demand imbalances, and assess the strength/weakness of buyers and sellers to make informed trading decisions. Order flow offers insight into the ongoing auction between market participants, clarifying the dynamics underlying price movement. Rather than depending on lagging indicators, order flow in the style that we profess, enables our subscribers to observe immediate buying and selling pressure, allowing for more accurate trade entries and exits. By analyzing order book depth and price action, traders can detect potential support and resistance levels, indicating where significant orders may be filled or interest may decrease. These visualizations illustrate trading volume at various price levels and highlight key areas of market activity that could act as support or resistance zones. Weighted-volume profiles present the distribution of trading volume within a specific price range, emphasizing levels of heightened trading interest. Order imbalance and delta metrics are used to evaluate notable discrepancies in aggressive buying and selling, which may indicate possible trend reversals or continuations. We do not discount the use of other freely available studies like Fibonacci, Support & Resistance, VWAP etc. as we use them freely in our screenshare.

Our intraday strategy is grounded in these principles. For further information, please visit http://www.tradeguidance.com, where you can complete a contact form to express your interest in monitoring price action intraday and utilizing real-time information from our screen sharing services for trading futures contracts. We offer ongoing monthly subscription specials, including current discounts for new readers wishing to trial our services.

Sample set of what we show on the active screen share for subscribers and use for our own trading

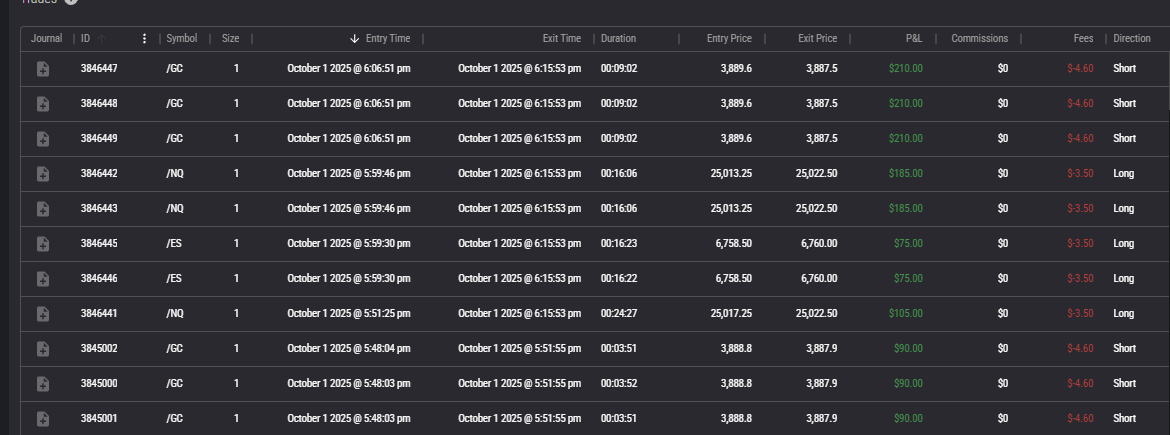

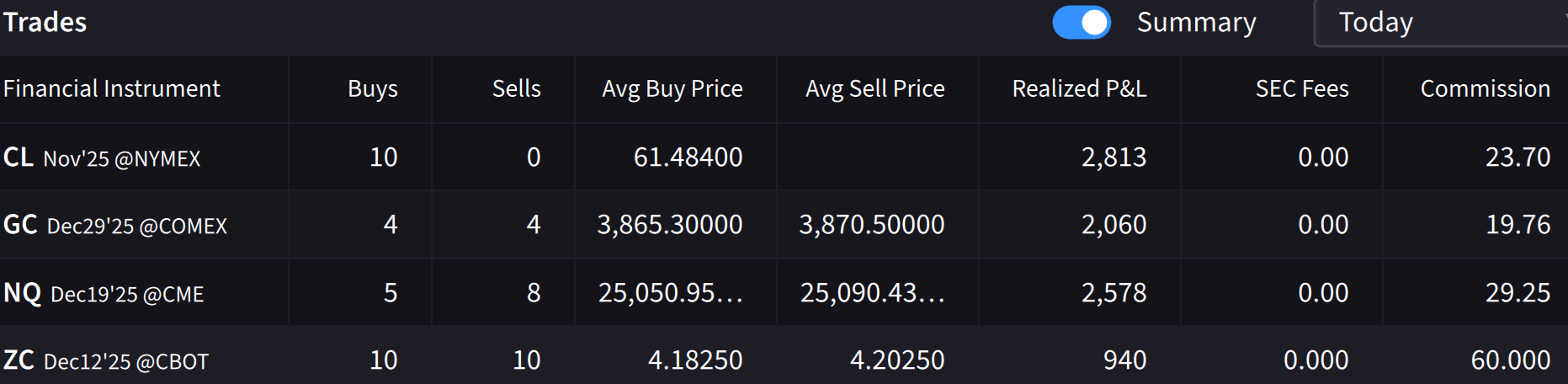

Actual results/executions

After hours futures trades