- Market Overview

- Futures

- Options

- Custom Charts

- Spread Charts

- Market Heat Maps

- Historical Data

- Stocks

- Real-Time Markets

- Site Register

- Mobile Website

- Trading Calendar

- Futures 101

- Commodity Symbols

- Real-Time Quotes

- CME Resource Center

- Farmer's Almanac

- USDA Reports

As Opendoor Touts Sweeping Job Cuts, Turnaround Plans, How Should You Play OPEN Stock?

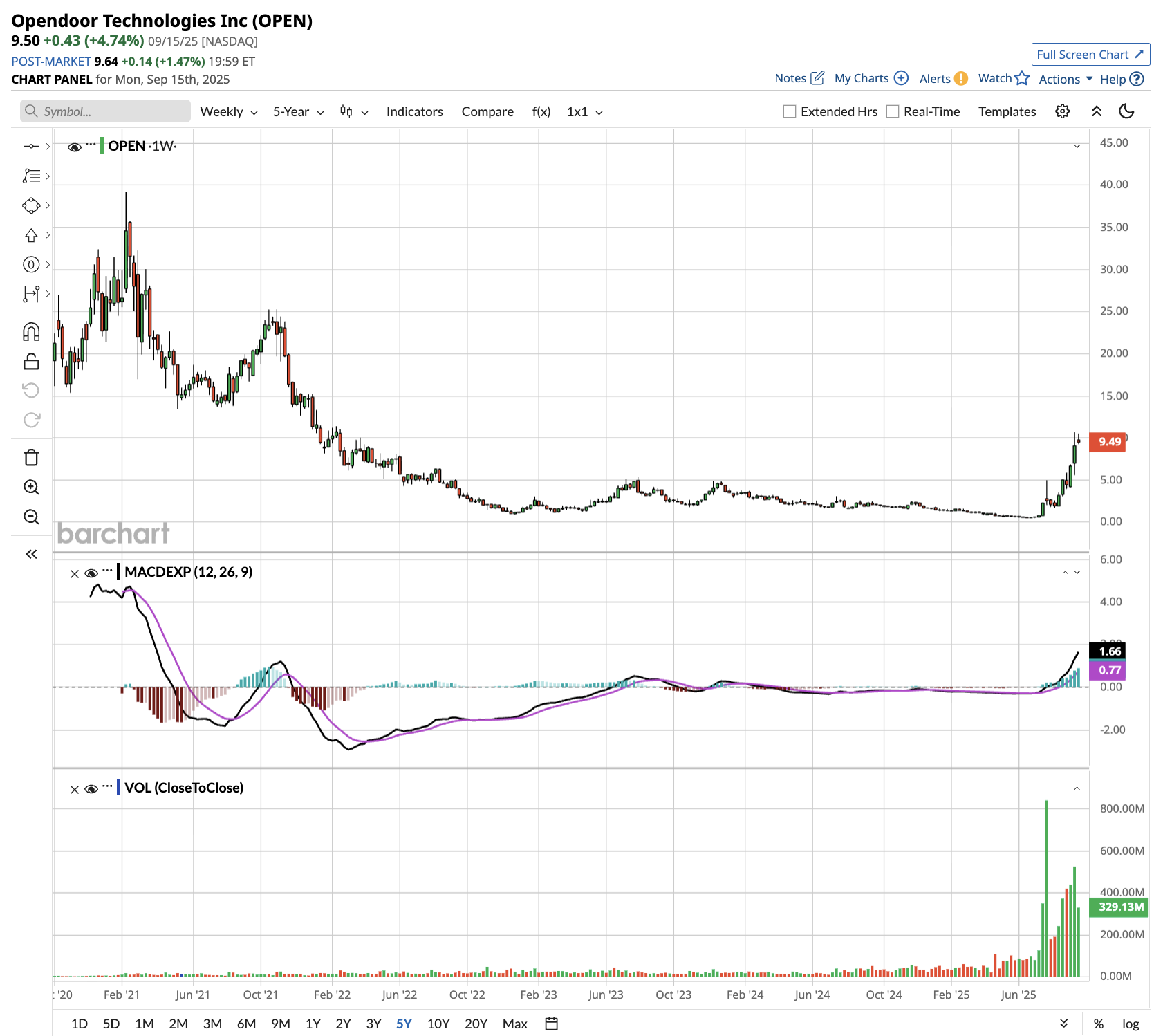

Opendoor Technologies (OPEN) is facing an inflection point as new leadership promises significant workforce reductions and operational overhauls. The meme stock has surged by over 460% in 2025, driven by enthusiasm from retail investors. However, it still trades 75% from all-time highs, underperforming the broader markets by a wide margin since its IPO in June 2020.

Opendoor recently appointed former Shopify (SHOP) executive Kaz Nejatian as CEO, while co-founder Keith Rabois has returned as chairman, which might signal a fundamental shift in strategy. Moreover, Rabois disclosed plans to reduce the workforce by 85%, from 1,400 to just 200 employees, indicating an aggressive cost-cutting approach to addressing the company's persistent cash burn problem. The leadership change is accompanied by a $40 million investment from Rabois and co-founder Eric Wu, providing a near-term financial runway.

However, investors should approach OPEN stock with extreme caution. Its house-flipping business model remains structurally challenged by elevated interest rates, with home acquisition volumes declining significantly.

Despite management's AI-powered transformation goals, Opendoor continues to operate as a low-margin, cash-burning enterprise with limited near-term growth prospects. The company’s free cash outflow totaled $620 million in 2024, while its net loss margin stood at 5%.

The meme-driven rally for OPEN stock, sparked by hedge fund manager Eric Jackson's promotional campaign, has disconnected the share price from the underlying fundamentals. Former CEO Carrie Wheeler's recent decision to sell $35 million worth of shares signals insider skepticism about current valuations.

Is OPEN Stock a Good Buy Right Now?

In Q2 of 2025, Opendoor delivered its first adjusted EBITDA-positive quarter in three years. In the June quarter, the company reported an adjusted EBITDA of $23 million, compared to a $5 million loss in the year-ago period.

It reported revenue of $1.6 billion, with a contribution margin of 4.4% compared to 6.3% last year due to an older inventory mix. Opendoor acquired 1,757 homes in Q2, below prior-year levels, as management widened spreads to manage risk amid deteriorating market conditions. Third-quarter guidance calls for just 1,200 home acquisitions and a negative adjusted EBITDA of $21-28 million, which suggests continued pressure.

Opendoor aims to pivot from a single-product company to a distributed platform working through real estate agents. Early results show promise with 2x more customers reaching final cash offers and 5x higher listing conversion rates. The new "Cash Plus" hybrid product reduces capital requirements while maintaining target margins.

What Is the Target Price for OPEN Stock?

Despite operational improvements, Opendoor operates in a challenging environment. Additionally, elevated interest rates continue to suppress buyer demand, leading to record de-listings and lower clearance rates. It expects sequential revenue declines through Q4, with contribution margins pressured by an unfavorable inventory mix.

While the strategic pivot toward agent partnerships is encouraging and could drive meaningful improvements in conversion, the macro housing environment remains severely constrained.

Analysts tracking OPEN stock forecast sales to decline by 12% year-over-year (YoY) to $4.13 billion in 2025. However, the top line is expected to expand to $9 billion in 2029. Wall Street also forecasts its adjusted net earnings to expand to $1 per share in 2029, compared to a loss of $0.37 per share in 2024.

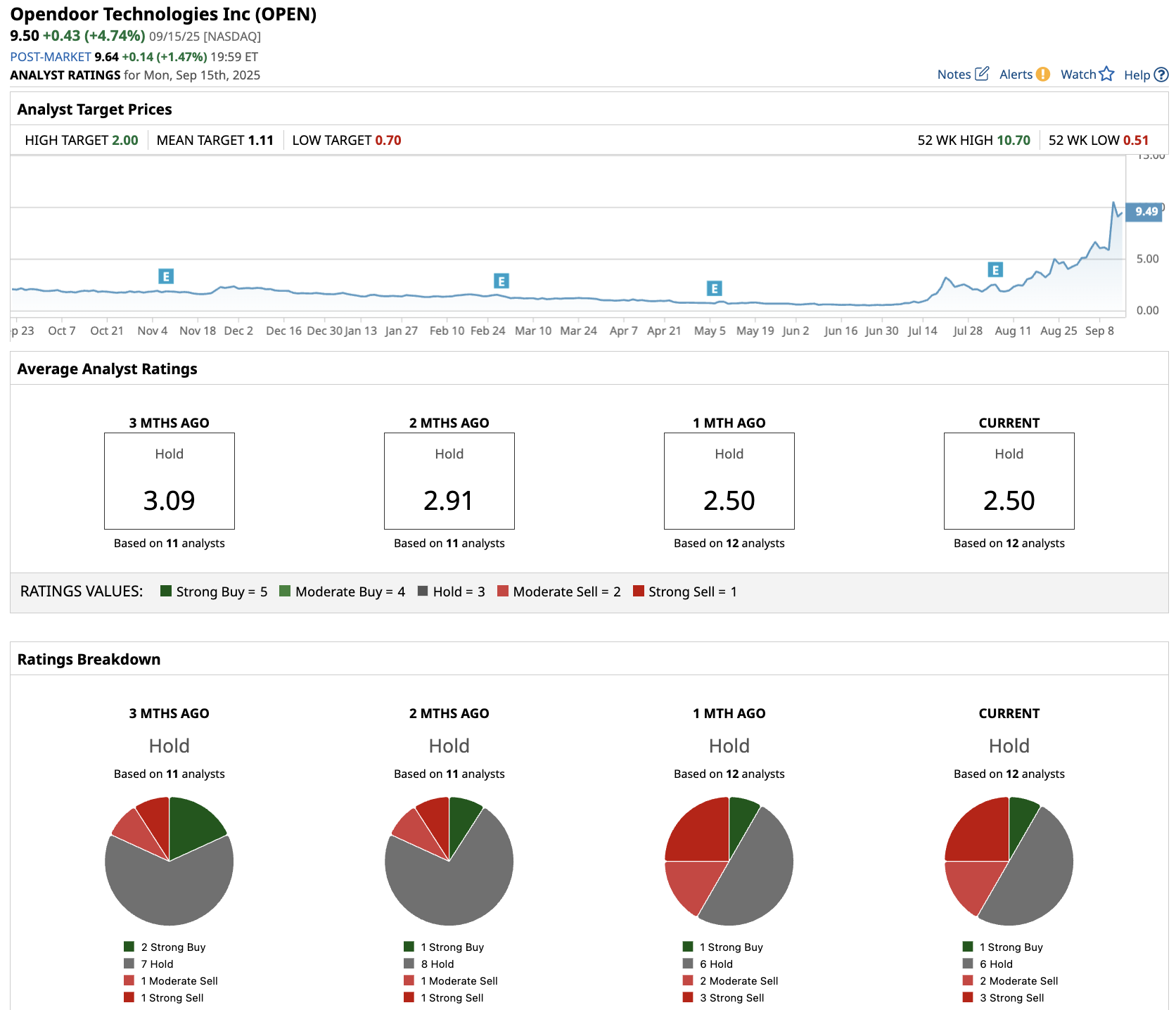

Of the 12 analysts covering the meme stock, one recommends “Strong Buy,” six recommend “Hold,” two recommend “Moderate Sell,” and three recommend “Strong Sell.” The average OPEN stock price target is $1.11, below the current price of $9.50.

The stock's recent meme-driven surge appears disconnected from its near-term fundamentals, making current valuations difficult to justify, despite its potential for transformation.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.