- Market Overview

- Futures

- Options

- Custom Charts

- Spread Charts

- Market Heat Maps

- Historical Data

- Stocks

- Real-Time Markets

- Site Register

- Mobile Website

- Trading Calendar

- Futures 101

- Commodity Symbols

- Real-Time Quotes

- CME Resource Center

- Farmer's Almanac

- USDA Reports

3 Tech Stocks to Buy Now for an AI ‘Rebirth’

/AI%20(artificial%20intelligence)/Artificial%20Intelligence%20technology%20concept%20by%20NicoEINino%20via%20Shutterstock.jpg)

Investors who lived through the internet boom of the nineties and the early 2000s keep asking the same quiet question. Is artificial intelligence (AI) just another hype cycle, or is it the kind of once-in-a-generation reset that creates fortunes? The market's own behavior this year offers a clue.

Software stocks have done tremendously well, especially those involved in AI. For example, Oracle (ORCL) has been known as a "legacy" company for a long time. The stock has done well in the 2010s and early in the post-pandemic era, but it still didn't dominate headlines on Wall Street.

Things have changed quickly, with ORCL stock climbing 96.2% in just the past six months. This company got hot almost overnight after its CEO, Larry Ellison, went on the podium during the Stargate project announcement.

Another example is IBM (IBM). It went from being a boring consulting company that was lucky to grow its revenue by 2% year-over-year (YoY). Today, it's seen as one of the firms spearheading cloud computing and quantum computing... such examples are everywhere.

This is why analysts believe AI isn't killing software but may be reviving it. A Goldman Sachs analyst said, "AI is going to work with software, and it's going to be a force multiplier for software," and he pointed out the following three stocks in particular.

Salesforce (CRM)

Salesforce (CRM) is the biggest customer relationship management company worldwide. Over time, Salesforce has expanded into a full Customer 360 suite. It has integrated data across departments to help companies engage customers more effectively.

But recently, Salesforce has been aggressively reinventing itself around AI, and this is why analysts like Goldman Sachs' Kash Rangan believe it's poised for a revival.

Salesforce has launched Agentforce, an AI agent platform that automates tasks across sales, service, and marketing. These AI agents can be the future of CRM, since customer support is expected to be largely automated.

Salesforce already has hundreds of thousands of customers, including 90% of the Fortune 500. These customers have years of data in Salesforce's Data Cloud. This makes it easy to deploy AI agents without starting from scratch. Salesforce has a huge head start over its competitors. Salesforce's AI and Data Cloud products have already surpassed $1 billion in annual revenue.

Analysts have a mean price target of $334, implying 38% upside.

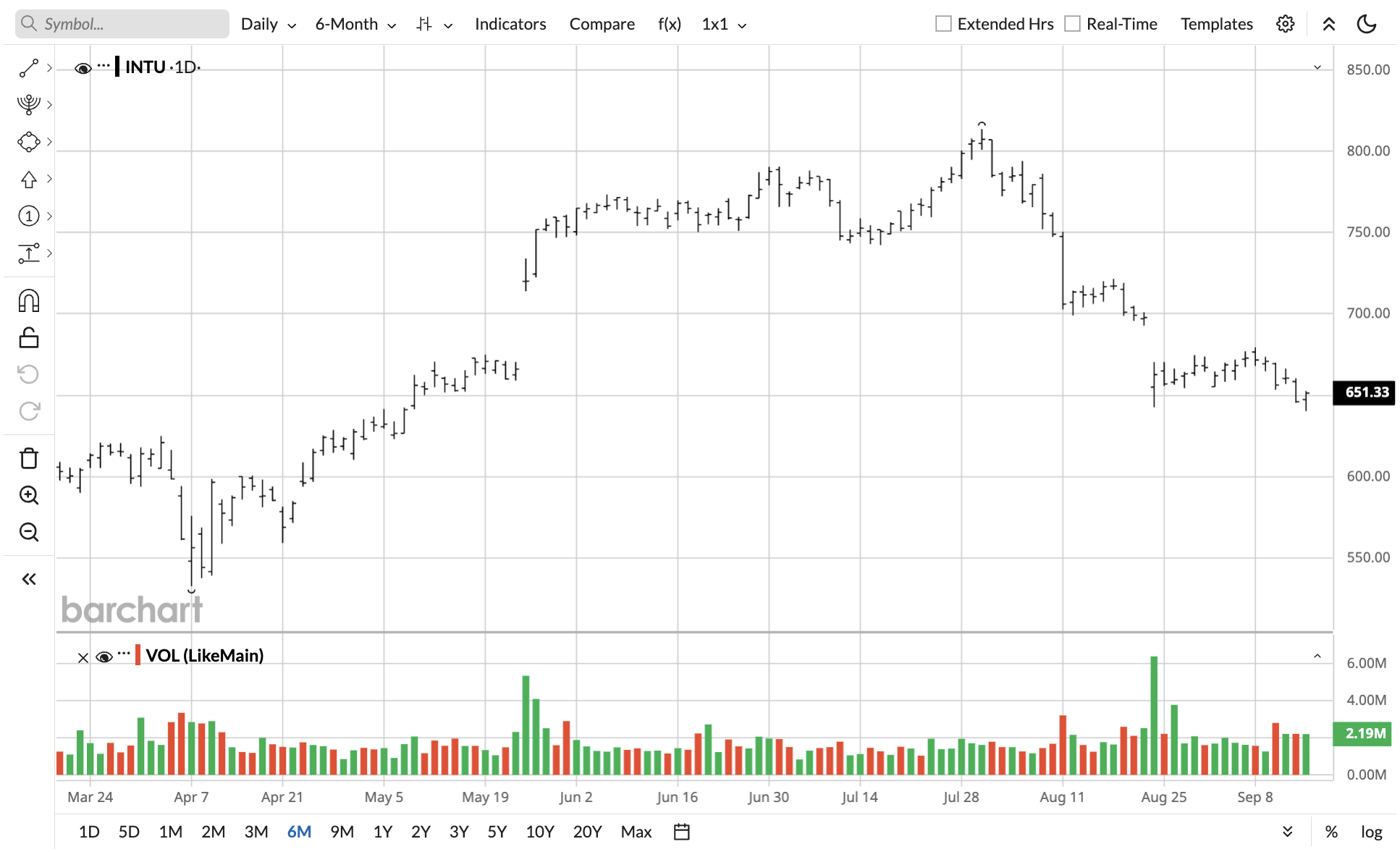

Intuit (INTU)

Intuit (INTU) is best known for its "do-it-yourself" financial software franchises like TurboTax, QuickBooks, Credit Karma, and Mailchimp. Its software suite can be supercharged thanks to AI, and customers are likely to keep using it as the software gets better.

TurboTax Live experts now spend ~20% less time per return thanks to AI pre-work. AI agents are already lifting average revenue per user. QuickBooks Online Advanced (AI-heavy) grew subscribers by 28% YoY.

Goldman’s view is that investors have priced many SaaS names as if they’ll be disintermediated, but those with unique data, distribution, and embedded workflow can still win. Intuit checks the criteria very well.

The mean price target is $841.6, implying ~29% upside.

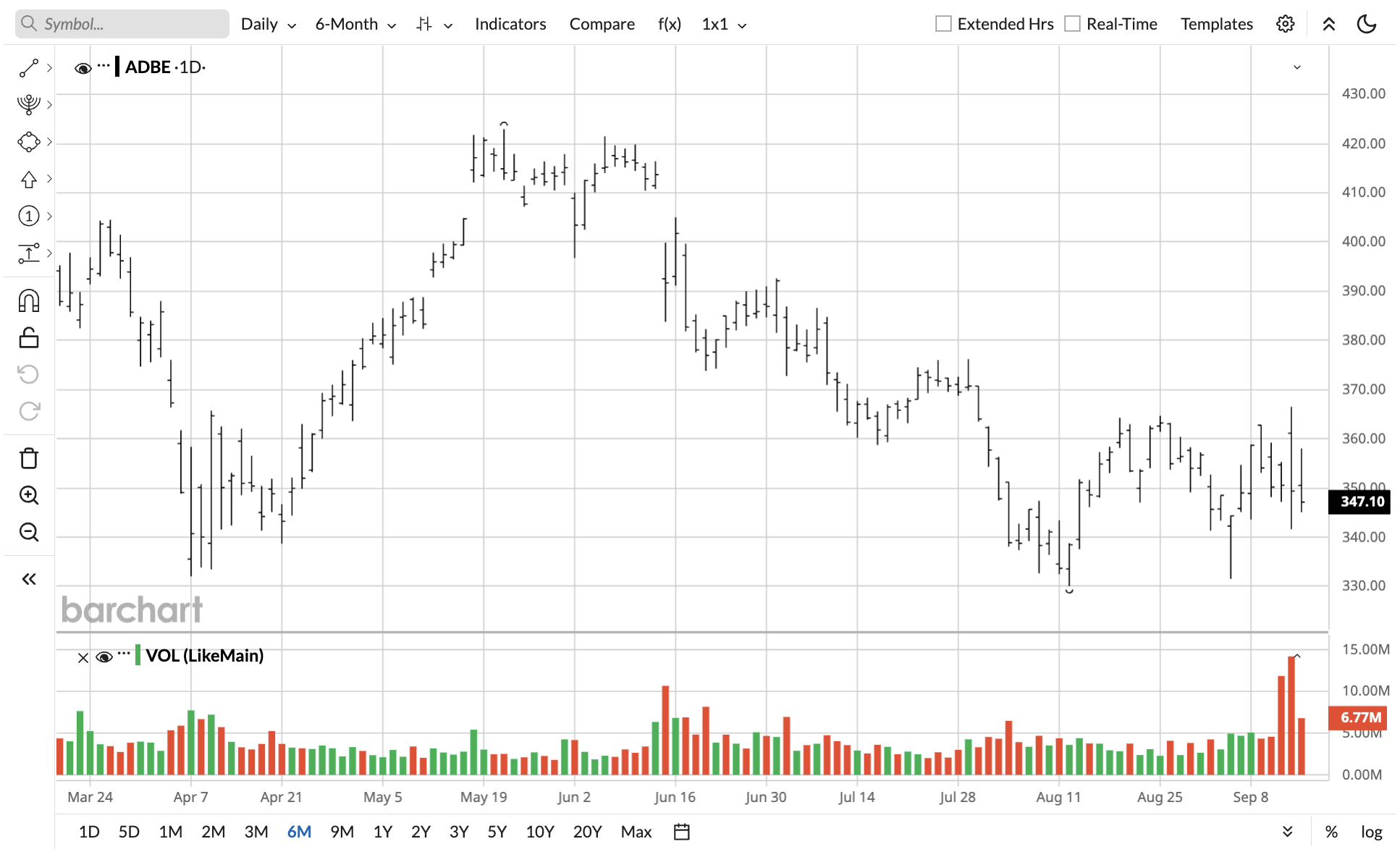

Adobe (ADBE)

Adobe (ADBE) is in one of the worst-hit sectors by AI, which includes Photoshop, Illustrator, Premiere, After Effects, Express, Firefly, etc. The argument is simple: why use Photoshop when you can edit almost any image with a prompt?

And in the future, AI may even be able to edit full videos, stealing market share from sources of Adobe's recurring revenue. Adobe also has a Digital Experience Cloud segment, which is a marketing suite.

AI has so far been Adobe's kryptonite. ADBE stock is down 20.6% year-to-date (YTD) and 32.3% over the past year.

However, Goldman Sachs' Kash Rangan likely believes that AI will benefit Adobe, since AI itself is not the whole workflow for professional users who pay. It instead lives inside an end-to-end workflow that Adobe offers for sticky recurring revenue.

Rangan reiterated "Buy" and lifted his price target to $570. The mean price target is $472.2, implying 38% upside.

On the date of publication, Omor Ibne Ehsan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.